what is a wholesale tax id number

The first thing that you need to do if you are interested in buying wholesale as a business is to get a Tax ID number by registering your business with the HMRC. A Tax ID is.

A Taxpayer Identification Number TIN is an identification number used by the Internal Revenue Service IRS in the administration of tax laws.

. Having a tax ID number allows an LLC to purchase items at wholesale from certain vendors whereas. State revenue departments assign these numbers to businesses that. Wholesale retail an Jewelry Store Sales Tax ID No Sellers Permit.

Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. It is the same as a wholesale tax number a sales tax ID or a sellers permit. The IRS issues your tax ID number to you after verifying that you are a legitimate business that qualifies for tax exemptions.

State Sales Tax ID - You need this IF you sell or buy Jewelry Store materials items merchandise food etc. Legally you must provide this number when you buy from a wholesale manufacturer or distributor. It is issued either by the Social.

You can buy or sell wholesale or retail. Resell means you are purchasing the goods to sell them to the public not for. Thus a Wholesale Tax ID Number OR State Sales Tax ID Number sellers permit wholesale license is used to sell.

A wholesale ID is also a sales tax ID number that you need if you sell or lease taxable equipment and or merchandise. You would need a number of. As a business owner youve probably been asked to provide a tax ID number when you buy from a wholesale distributor.

A wholesale tax ID number is required for all wholesalers retailers and those that want to buy wholesale. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers. LLCs that sell items to the public are required to get a tax ID.

Businesses that buy wholesale do need to have a tax ID. Thus a Wholesale Tax ID Number OR State Sales Tax ID Number sellers permit wholesale license is used to. A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise.

It is issued either by the Social Security. You can buy or sell wholesale or retail with this number. A Tax ID Number or so-called TIN is a special identification code that is used in the business world mainly at different tax administrations.

A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers. AKA resale ID sellers permit reseller license etc. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers.

A business tax wholesale number allows a business to purchase goods for resell without paying sales tax. Businesses that buy wholesale do need to have a tax ID. Legally you must provide this number when you buy from a wholesale manufacturer or distributor.

The IRS issues your tax ID number to you after verifying that you.

Do I Need A License To Buy Wholesale

Need A Resale Certificate Reseller Permit Learn How In 5 Minutes Salehoo

Differences Between A Tax Resale Certificate And A W 9 Form

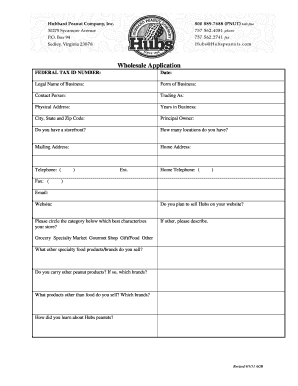

Fillable Online Wholesale Application Federal Tax Id Number Date Legal Name Of Business Form Of Business Contact Person Trading As Physical Address Years In Business City State And Zip Code Principal Owner

Nomadic Brunette Wholesale Must Have Tax Id Resellers License Facebook

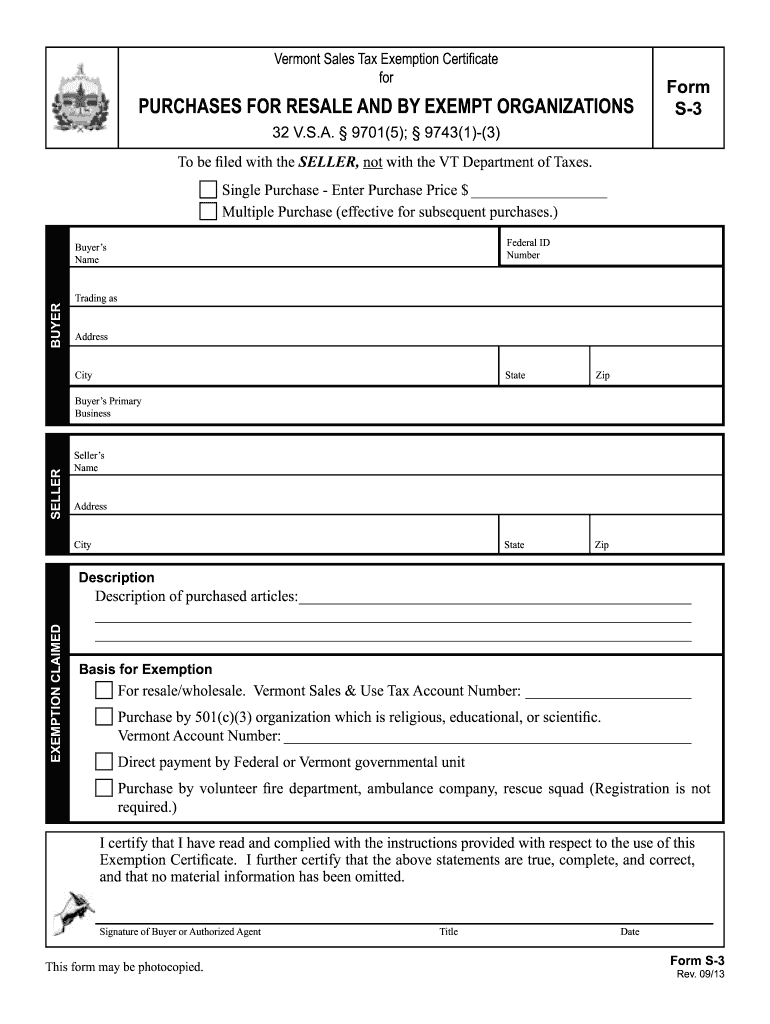

Vermont Sales Tax Form S 3 2003 Fill Out Sign Online Dochub

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

How To Get A Resellers Permit So You Can Buy Wholesale Products Liquidation Pallets Youtube

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

D E Wholesale Tees Tax Id Required Facebook

How To Get A Wholesale License In Florida Fast Filings

Can I Use My Ein Number To Buy Wholesale Quora

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark